are foreign gifts taxable in the us

Citizens and residents are subject to a maximum rate of 40 with exemption of 5 million indexed for inflation. Gifts to foreign persons are subject to the same rules governing any gift that a US.

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Lets review the basics of foreign gift tax in the us.

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

. There are no specific IRS taxes on gifts received from a foreign person. They are non-US persons and neither of them have ever. You will not have to pay tax on this.

Person receives a gift from a foreign person that specific transaction is not taxable. Gifts or inheritances received from foreign estates corporations or partnerships are subject to some special rules however. The united states internal revenue service says that a gift is any.

In general a foreign gift or bequest is any amount received from a person other than a US. The United States Internal Revenue Service says that a gift is. The source of the gift eg.

Which Gifts Are Taxable. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more. A gift tax or known originally as inheritance tax is a tax imposed on the transfer of ownership of property during the givers life.

On the other hand non-US. Therefore with the current exemption at 545 million the estate at issue is going to have to pay 40 estate tax on the 255 million that. In other words if a US.

Tax with no Income Davids parents are citizens of China. There are differences in the foreign gift tax treatment of cash and property. If you receive a non-cash gift from a foreign person it may be taxable if it is US.

Domiciliaries will be subject to transfer taxes on US. Employer opening a bank account This. Situs assets only but have no exemption available to them for lifetime gifts and are taxable on the first 1 of.

Which Gifts Are Taxable. Citizens and residents are subject to a maximum gift tax rate of. Person a foreign person that the recipient treats as a gift or bequest and excludes from gross.

If you are given money from a non-US citizen as a gift however you do need to declare it on Form 3520 if it is over 100000 in value. 1 us tax implications for gifts from foreign citizens. A non-resident alien donor.

Examples of Foreign Gift Reporting Tax Example 1. No the gift is not taxable but it is reported on Form 3520. 1 us tax implications for gifts from foreign citizens.

Person receives a gift from a foreign person that specific transaction is not taxable. Gift Article Share Haitis government is set to seek the assistance of foreign security forces amid compounding crises that have plunged the country into deepening chaos. This interview will help you determine if the gift you received is taxable.

No gift tax applies to. Citizen or resident makes. The united states internal revenue service says that a gift is any.

Nonresidents are subject to the same tax rates but with exemption of. Lets review the basics of foreign gift tax in the us. In the United States it is the estate that is taxed.

What Is The Gift Tax In India And How Does It Affect Nris

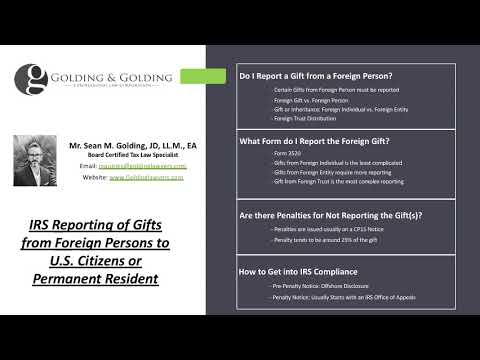

Is There A Foreign Gift Tax In The United States Irs Overview

U S Citizens Uscs And Lawful Permanent Residents Lprs Caution When Making Gifts Us Tax Court Recently Ruled A 1972 Gift By Sumner Redstone Still Open To Irs Challenge Tax Expatriation

Gifts From Foreign Person How U S Citizens Residents Report A Foreign Gift To Irs On Form 3520 Youtube

How Many People Pay The Estate Tax Tax Policy Center

Tax Planning For Sexual Harassment Claims Us Taxpayers Foreign Gifts White Paper Lorman Education Services

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

The Gift Tax Turbotax Tax Tips Videos

Tax Forms Irs Tax Forms Bankrate Com

Annual Gift Tax Exclusions First Republic Bank

Form 3520 Reporting Foreign Trusts And Gifts For Us Citizens

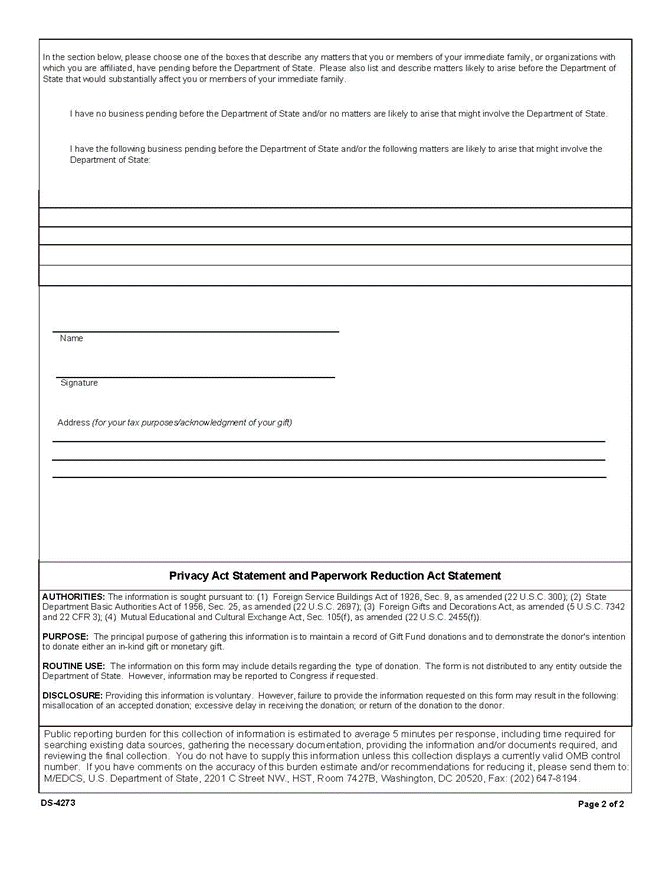

2 Fam 960 Solicitation And Or Acceptance Of Gifts By The Department Of State

Gifts From Foreign Persons New Irs Requirements 2022

The New Exemption From Required Information Reporting The Cpa Journal

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

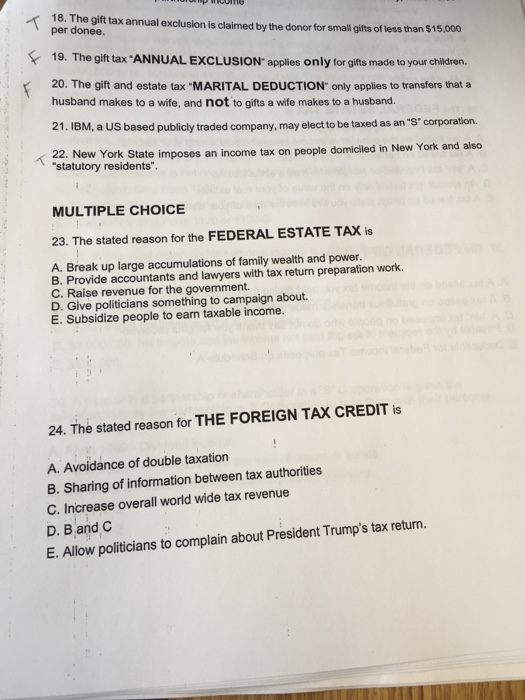

Solved 18 The Gift Tax Annual Exclusion Is Claimed By The Chegg Com